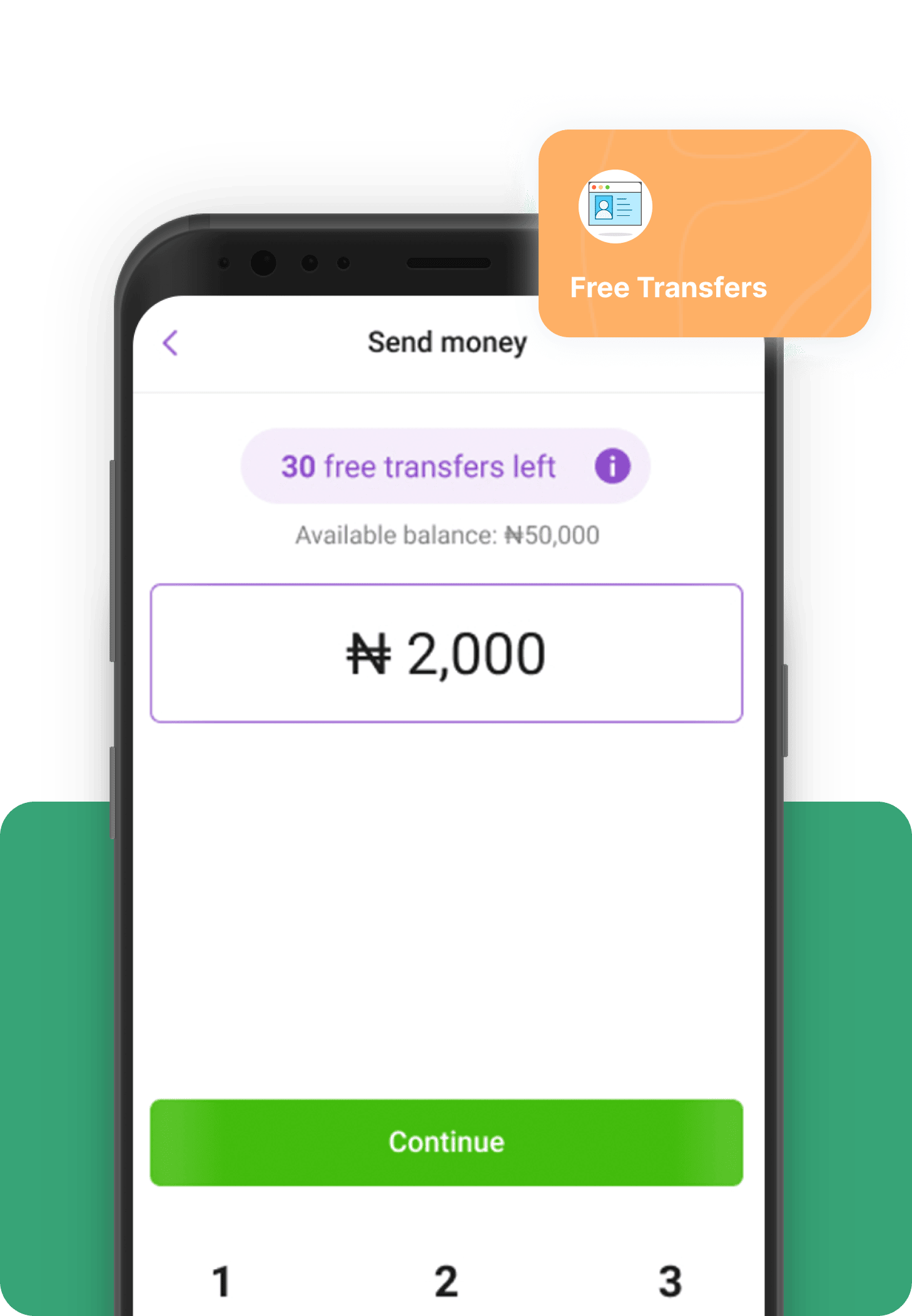

Enjoy 30 Free Bank Transfers Monthly

No more transfer charges or hidden fees. Bank, transfer and keep your money just the way you left it. By default, all FairMoney customers a maximum of N200,000 deposit per day, a maximum of N200,000 bank transfers per day, a maximum of N500,000 in the account balance. To enjoy higher limits, you can simply request for an upgrade!

To fund your FairMoney account:

- Log in to the latest version of the FairMoney app.

- You will see the ‘Add Money’ button on the upper-left-hand

corner of the home screen

- Tap that button

- Select your preferred option to Fund your account by either

a bank transfer or a USSD transfer

- For bank transfer, copy your FairMoney bank account

number and make a transfer from any bank.

- For the USSD method, you are required to input the amount

you would like to fund your account with.

- When this is done, you can dial the USSD code for your

bank from the FairMoney app and fund your FairMoney

account.

Yes. You can transfer to any bank account in Nigeria directly from your FairMoney app.

Yes, by default, all FairMoney customers have the following limits:

- A maximum of N200,000 deposit per day

- A maximum of N200,000 bank transfers per day

- A maximum of N500,000 in the account balance

To upgrade your account, you need to provide us with a copy of a government-issued ID (like your driver’s licence, national ID card or voter’s card) and any document with your full name and house address as a proof of address (utility bill, bank statement, LAWMA Waste Bill). These documents should be sent to myaccount@fairmoney.ng